What are some key factors to consider when looking for affordable health insurance?

When searching for affordable health insurance, consider factors such as monthly premiums, deductibles, co-payments, co-insurance, out-of-pocket maximums, provider networks, prescription drug coverage, and any available subsidies or tax credits. It’s essential to balance premium costs with potential out-of-pocket expenses to find a plan that fits your budget and healthcare needs.

How can I determine if I qualify for subsidies or financial assistance for health insurance?

You can determine if you qualify for subsidies or financial assistance by visiting the Health Insurance Marketplace (HealthCare.gov) or your state’s health insurance exchange website. Eligibility is based on factors like income level and household size. Subsidies can help lower monthly premiums and reduce out-of-pocket costs for eligible individuals and families.

What are some alternatives to traditional health insurance plans for individuals and families on a budget?

Alternatives to traditional health insurance plans include short-term health insurance, health sharing ministries, and catastrophic health insurance plans. These options may offer lower premiums but typically have limited coverage or eligibility requirements. It’s important to carefully review the coverage details and exclusions before choosing an alternative plan.

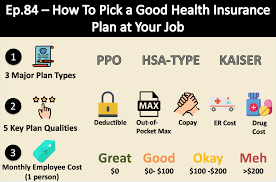

How can I compare health insurance plans effectively to find the best value?

compare health insurance plans effectively, evaluate key factors such as premium costs, deductibles, co-payments, co-insurance, out-of-pocket maximums, provider networks, and prescription drug coverage. Use online comparison tools, review plan summaries, and consider contacting insurance brokers or agents for personalized assistance.

What should I do if I can’t afford health insurance but don’t qualify for subsidies?

If you can’t afford health insurance and don’t qualify for subsidies, explore options such as Medicaid (if eligible based on income and state guidelines), community health centers for low-cost care, and negotiating healthcare costs directly with providers. Some employers may also offer health benefits or wellness programs that could help lower healthcare expenses.

Table: Tips for Finding Affordable Health Insurance

| Tip | Description |

|---|---|

| Shop Around | Compare premiums and benefits from multiple insurers to find competitive pricing and coverage. |

| Consider High-Deductible Plans | High-deductible plans often have lower premiums but require higher out-of-pocket spending. |

| Check for Subsidies | Determine if you qualify for premium subsidies or tax credits through the Health Insurance Marketplace or state exchanges. |

| Evaluate Network Coverage | Ensure your preferred doctors and hospitals are in-network to avoid higher out-of-pocket costs. |

| Review Prescription Drug Coverage | Assess the formulary and costs for medications you regularly take to understand coverage details. |

| Explore Alternative Plans | Investigate short-term health insurance, health sharing ministries, or catastrophic plans for lower-cost options. |

| Maximize Preventive Care Benefits | Take advantage of no-cost preventive services to maintain health and avoid more expensive treatments. |

| Understand Cost-Sharing Options | Familiarize yourself with co-payments, co-insurance, and out-of-pocket maximums to budget effectively for healthcare expenses. |

| Consider Telehealth Options | Telehealth services can offer convenient and cost-effective care options, potentially reducing overall healthcare costs. |

| Review Plan Details Carefully | Read plan documents thoroughly to understand coverage limits, exclusions, and any restrictions that may apply. |